The Social Capital CEO recently told CNBC that America’s richest should not get a bailout from taxpayers. Instead, they should suffer the consequences like everyone else.

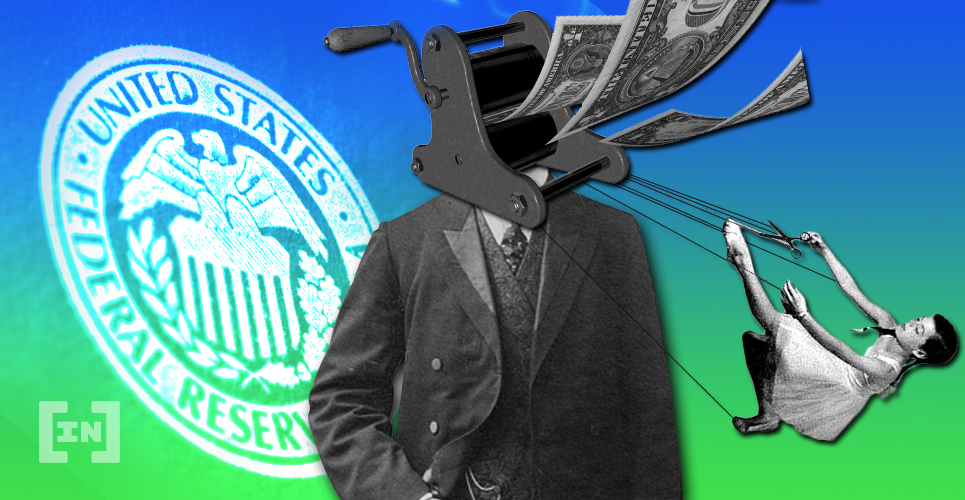

The U.S. stimulus bill passed last month advertised itself as a striking a ‘balance’ between supporting everyday Americans, small businesses, and corporations. However, the Fed’s incessant money-printing tells a different story—one where boosting financial markets and providing support for large corporate entities seems to be its first priority.

The dangers of prioritizing the biggest corporate entities is that Americans will be left with little to no spending power. This will obviously only worsen the economic blow. This was the case Social Capital CEO Chamath Palihapitiya made recently on CNBC in strong language.

‘Let Them Get Wiped Out’

Social Capital CEO Chamath Palihapitiya recently went on CNBC and argued that the excessive concern over how the richest corporations and Americans would fare during this crisis is wrong.

“Who cares? Let them get wiped out?” he said.

The U.S. shouldn’t bail out billionaires and hedge funds during the coronavirus pandemic, Social Capital CEO Chamath Palihapitiya says. “Who cares? Let them get wiped out.” https://t.co/dIbizumtqG pic.twitter.com/u8BSVvr0B1

— CNBC (@CNBC) April 9, 2020

The comment went viral recently and Americans seemed to agree.

Here we go .. bailout for everyone .. but YOU the guy on main street who played by the rules, invested in their 401Ks, and HELD when the market dropped .. .. you should have known better .. you get diluted and wiped out.

— MRKD26 (@MRKD26) April 9, 2020

Palihapitiya stressed that there was “a lie perpetuated by Wall Street” that when a corporation fails it necessarily fires all its workers. In fact, as Palihapitiya argues, most bankruptcies end up simply getting reacquired. The people that really get hurt are those that are the speculators and the ones that hold the equities—and they should be allowed to get wiped out.

So, in Palihapitiya’s words, these people and entities deserve no support; they are not the ones holding the economy together, and that is the bargain they chose when they decided to be only investors.

Also a Bitcoin Bull

Palihapitiya’s opinions are inherently tied to the strong belief that nobody in the market deserves any favors. He so happens to be a strong believer in Bitcoin.

The Social Capital CEO said he bought a lot of Bitcoin back in 2013 when it was trading for just $80. He claims that he owned around 5% of all BTC in circulation at one point.

Because the financial system is looking weaker than ever, Bitcoin could become a safe haven, but it all depends on which path society chooses. Because of this, Palihapitiya maintains that “it’s either zero or it’s millions.” [Forbes]

However, he has not suggested that Bitcoin will immediately fare well if this economic crisis worsens. In fact, it’s still an extremely speculative investment that will oscillate even more wildly during this crisis. However, if Palihapitiya is correct, there is potential for there to be light at the end of the tunnel.

Do you need trading guidance during this Coronavirus outbreak? BeInCrypto is here to help! Join our Telegram Trading Community for Market Updates, exclusive Trading Signals and a FREE Trading Course! Images courtesy of Shutterstock, Trading View and Twitter.

Disclaimer. Read MoreRead Less

As a leading organization in blockchain and fintech news, BeInCrypto always makes every effort to adhere to a strict set of editorial policies and practice the highest level of journalistic standards. That being said, we always encourage and urge readers to conduct their own research in relation to any claims made in this article. This article is intended as news or presented for informational purposes only. The topic of the article and information provided could potentially impact the value of a digital asset or cryptocurrency but is never intended to do so. Likewise, the content of the article and information provided within is not intended to, and does not, present sufficient information for the purposes of making a financial decision or investment. This article is explicitly not intended to be financial advice, is not financial advice, and should not be construed as financial advice. The content and information provided in this article were not prepared by a certified financial professional. All readers should always conduct their own due diligence with a certified financial professional before making any investment decisions. The author of this article may, at the time of its writing, hold any amount of Bitcoin, cryptocurrency, other digital currency, or financial instruments — including but not limited to any that appear in the contents of this article.

Business - Latest - Google News

April 11, 2020 at 11:26AM

https://ift.tt/2wx4F6R

Let Billionaires and Hedge Funds Get ‘Wiped Out,’ Says Bitcoin Bull - BeInCrypto

Business - Latest - Google News

https://ift.tt/2Rx7A4Y

Bagikan Berita Ini

0 Response to "Let Billionaires and Hedge Funds Get ‘Wiped Out,’ Says Bitcoin Bull - BeInCrypto"

Post a Comment