The American airstrike that killed Iranian commander Qassem Soleimani in Baghdad Thursday hit financial markets almost immediately with oil prices jumping, stock indices down, and weapons manufacturer stocks higher.

The airstrike adds considerable tension to the delicate region, and raises concerns that escalation could result in oil supply disruptions that could push prices higher — prices that would ultimately end up being paid by consumers when they fill up their cars. Crude oil prices jumped around 4% from $61 a barrel to almost $64 before calming down slightly.

A deteriorating relationship between the U.S. and Iran has the potential to affect consumers and the U.S. economy, though there are multiple factors that should keep things stable for people at the pump.

Patrick DeHaan, the head of petroleum analysis at GasBuddy, told Yahoo Finance that the initial reactions may add 3 to 7 cents per gallon to gas prices, or even 5 to 10 cents per gallon. But far more importantly, how Iran decides to react or retaliate will set the tone.

“The sky is the limit based on their potential reaction,” DeHaan said of Iran.

However, he noted there is significant insulation that could shield impact in the form of Saudi Arabia. An enemy of Iran, the country “holds sizable spare capacity that could be utilized to soften any impact to oil supply,” DeHaan said.

Lots of supply to keep things under control

As ING Group wrote in a research note Friday, it takes a lot to scare the oil market because supply is so comfortable.

Saudi Arabia’s capacity is one of the many reasons prices at the pump could stay under control even if the situation escalates.

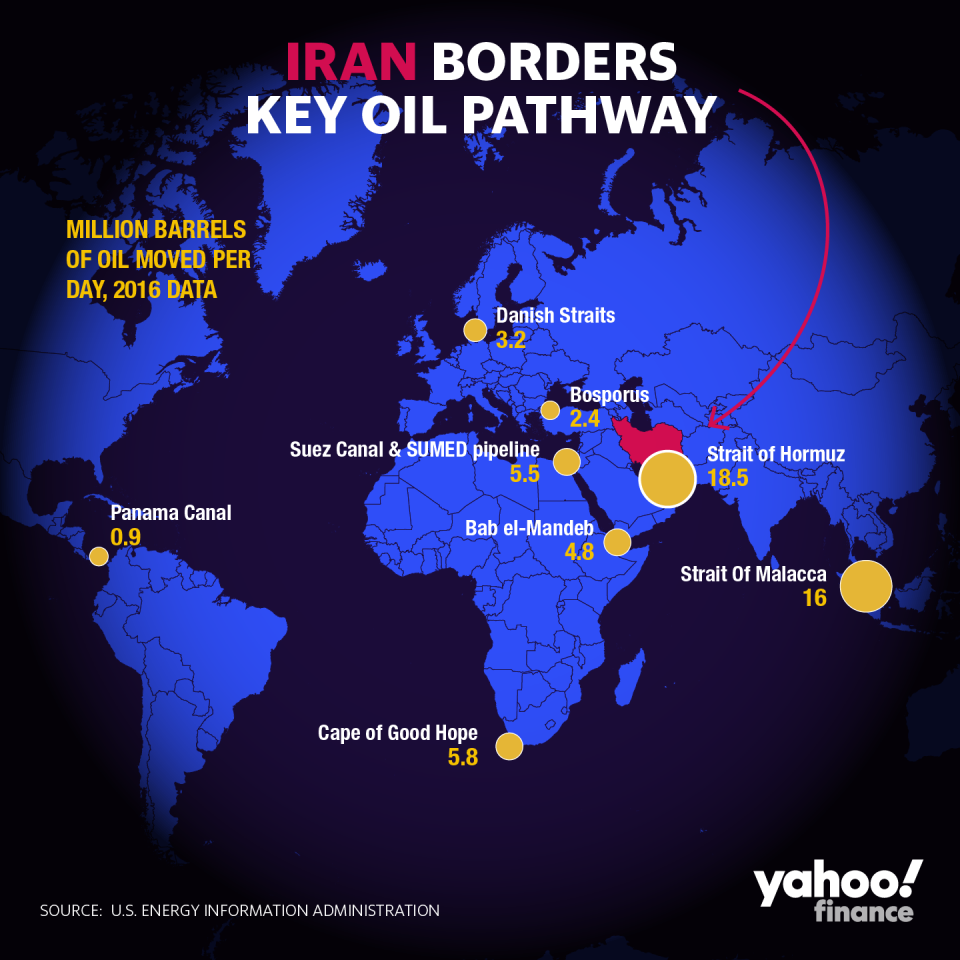

It’s not just capacity but Saudi Arabia’s diversified portfolio of export options. Even if Iran were to try to block the Strait of Hormuz, ING noted that the country’s new pipeline could allow the country to ship its oil via the Red Sea, limiting potentially severe effects.

Oil exports that use the Strait of Hormuz make up around 20% of global oil consumption, and its blockage could send prices up to $150 per barrel.

In September, when drone attacks hit Saudi Arabia’s oil production facilities — an attack that was blamed on Iran — prices rose, but then fell quickly as the situation contained itself and the Saudis managed to get supply back up.

American shale to the rescue — and the strategic energy reserve

Another reason gas prices are shielded is the fact that it’s an election year. As ING pointed out, the fact that it’s an election year means President Trump may be more inclined to open the U.S. Strategic Petroleum Reserves should supply get tight.

Oil and gas prices may rise a little bit, causing drivers to pay more at the tank, but U.S. shale players could stand to further insulate prices from rising too high and keep GDP from being affected too much. In the past few years, American shale production has skyrocketed to around 9.2 million barrels per day, from 5.2 million in 2017. This supply, as RSM Chief Economist Joe Brusuelas noted, has the potential to contain problems across the globe.

Furthermore, higher oil prices usually spur capital expenditures for domestic energy operations, since higher oil prices mean a better chance at profitability for frackers. Though consumers may end up spending more, it could end up a wash for GDP growth, offsetting the consumer harm.

“Our general rule of thumb,” Goldman Sachs wrote back in September, “is that a $10/barrel increase in oil prices typically lowers the GDP contribution from consumption by 0.15% cumulatively.”

In other words, the price changes are usually enough to affect consumers’ behavior — if the prices last and affect Americans at the pump for a long time. According to Deutsche Bank, for every one-cent rise in gas prices, consumer spending on non-energy goods and services falls $1.16 billion per year.

-

Ethan Wolff-Mann is a writer at Yahoo Finance focusing on consumer issues, personal finance, retail, airlines, and more. Follow him on Twitter @ewolffmann.

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit.

Business - Latest - Google News

January 04, 2020 at 09:53AM

https://ift.tt/35o5Lgs

What the Iran strike means for gas prices - AOL

Business - Latest - Google News

https://ift.tt/2Rx7A4Y

Bagikan Berita Ini

0 Response to "What the Iran strike means for gas prices - AOL"

Post a Comment