Can the oil market stomach oil disruptions?

Any significant disruption in the Middle East could tighten the global balance sheet fairly quickly, and it wouldn’t take too much to eat into the 900Mbbls/d surplus that we currently forecast over the first half of 2020. However, saying that, if the Iranians attempted to block oil shipments through the Strait of Hormuz, the Saudis could increase oil flows through their East-West pipeline, and ship from the Red Sea instead. Aramco was in fact set to complete expansion work on the pipeline last year, which would take capacity from 5 to 7MMbbls/d. Saudi crude oil exports were estimated at 6.73MMbbls/d in December, with 88% of this going through the Strait of Hormuz, suggesting there is plenty of capacity to shift flows through the pipeline.

Any significant and sustained disruption would likely mean the end of the OPEC+ deal to cut production by 1.7MMbbls/d, with members wanting to ensure adequate supply for the market. There is also the potential for emergency releases from government stocks. President Trump would want to avoid higher oil prices, particularly in an election year, and so we could see releases from the US Strategic Petroleum Reserves, which currently stands at around 635MMbbls.

The oil market over the last year has been fairly good at shrugging off large oil disruptions, and growing tensions in the Middle East. This attitude does appear to be partly a result of the comfortable supply and demand balance for the global oil market, and this is a trend that is unlikely to change at least over the first half of 2020, due to the surplus environment.

Until there is clarity on how the Iranians may retaliate to the US airstrike, we continue to believe from a supply and demand point of view that ICE Brent should trend back towards US$60/bbl over the course of this quarter.

Business - Latest - Google News

January 03, 2020 at 09:07PM

https://ift.tt/2QN3JS3

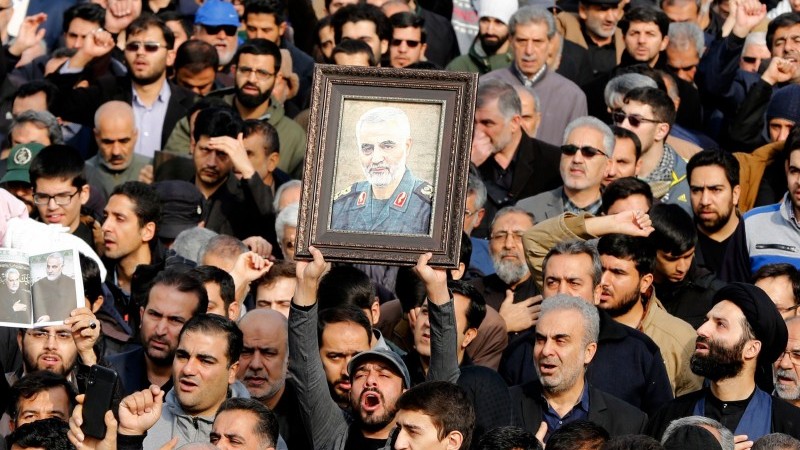

What the US airstrike means for oil and global markets - ING Think

Business - Latest - Google News

https://ift.tt/2Rx7A4Y

Bagikan Berita Ini

0 Response to "What the US airstrike means for oil and global markets - ING Think"

Post a Comment